Entrepreneurship can be a risky undertaking. It requires hard work, tenacity, and grit to make your business a success.

However, the rewards can be rewarding too. The financial gains can help provide a comfortable living or even allow you to advance your philanthropic goals. There is a growing consensus that studying entrepreneurship from a behavioral perspective is an important and necessary direction for the field.

Innovative Solutions

Entrepreneurs are often the creators of innovative solutions that help businesses thrive. Their ideas can revolutionize industries and create new opportunities for consumers. They also can create jobs and boost a country’s economy by increasing gross national income.

The most successful entrepreneurs are those who have a clear vision and are willing to take risks to achieve their goals. They must be able to manage their finances and work with others. They must be able to recognize and adapt to change in the market. They must be able to make far-sighted decisions, and they must be able to motivate and mentor people.

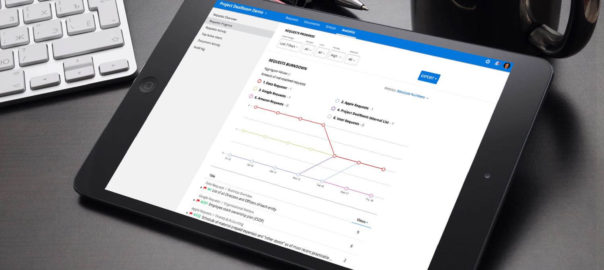

In addition, they should be able to develop their own business model, locate emerging technology and understand trends. Entrepreneurs need innovative solutions that help them grow their businesses, create new products and improve the quality of life in their communities. These solutions can include introducing new technology, creating partnerships, and encouraging innovation. They can also help entrepreneurs to become more productive by using business process management tools.

Financial Stability

Entrepreneurship involves assuming the risk of running a business. This type of activity is important to a country’s economy, as it generates wealth and jobs. It also contributes to the growth of new products and services.

Many people choose to become entrepreneurs because they can’t find jobs in the traditional employment sector. They want to be in control of their own schedules and have more freedom to travel or spend time with family. They also like the idea of creating a product that will solve a problem or add value to existing products and services.

Financial stability refers to the ability of the key financial markets and institutions to intermediate financial funds and manages risks, thus supporting growth in economic activity. It is an increasingly crucial issue, given the increasing importance of the global financial system and its vulnerability to crisis situations. The analysis of financial stability requires a broad perspective, including the assessment of the impact of individual factors and their interaction.

Flexibility

Entrepreneurship is often a popular option for people who want to work flexible hours. This can be particularly attractive to parents with children, students or those who are pursuing their passion. This flexibility also makes it easier for entrepreneurs to travel or work from home without sacrificing their productivity.

Entrepreneurs often want to make the world a better place. Whether they are pushing for space exploration or creating an affordable alternative to traditional medical care, many entrepreneurs strive to change the world for the better.

This may be why entrepreneurship is often associated with social change, and Canada ranks high among the nations surveyed in 2021/2022 in terms of entrepreneurs who are making a difference in their communities. Entrepreneurs who are committed to improving the lives of their customers and transforming their industry can be particularly powerful in their impact. However, it is important for entrepreneurs to maintain focus and avoid getting distracted by their own success.

Independence

When most people think of entrepreneurship, they may think of new ideas, passion, hard work, and the potential for great reward. While focusing on money should not be the main driver behind any business, it can be an important part of the motivation to keep going and growing. Financial independence is also a benefit of entrepreneurship because it allows entrepreneurs to manage their own money and not be bound by the whims of others.

Entrepreneurship contributes to economic growth by creating exciting new businesses. The influx of new products and services helps increase profits for investors, suppliers, distributors, and customers. The resulting economic growth can create jobs and stimulate the economy in general. It can even be used to help with public projects and infrastructure. Moreover, entrepreneurs can align their businesses to their personal values, like sustainability or politics. This can make the entire experience much more rewarding.